Contrary to the image, buying a private island isn’t just for the glitterati and titans of industry – although, along with jets and yachts, they surely rank among the world’s most exclusive trappings of wealth. From Scotland to the Bahamas and all points in between, private islands offer luxury and glamour, along with the privacy.

They’re associated with ultra-luxury as well as carrying a whiff of aristocracy, and even though islands can be bought in various parts of the world for less than US$100,000, it is the sun-drenched archipelagos of the Caribbean, Central America and the South Pacific that truly capture the imagination, where islands can run in the millions of dollars.

Private island ownership has a long history among the elite: legendary Oscar-winning actor Marlon Brando blazed a trail in 1966 when he bought an island in Tahiti for US$270,000. Actors Johnny Depp and Nicolas Cage famously bought islands in the Bahamas. Leonardo DiCaprio owns 42-hectare Blackadore Caye island off the coast of Belize, which he allegedly still plans to develop into a eco-friendly resort. George Clooney owns a US$12 million island on England’s River Thames, complete with historic castle, and Steven Spielberg uses his island in Portugal’s Madeira archipelago for escapes with the family.

It’s not just movie stars that have got in on the island game either: former Oracle CEO Larry Ellison and Virgin boss Richard Branson have planted flags in Hawaii and British Virgin Islands, respectively, and the family of Caroline of Monaco’s daughter-in-law Beatrice Borromeo owns five off the coast of Italy.

Buying a private island isn’t technically much different than buying any other real estate asset. The same considerations apply: is it being purchased for personal use, rental or development? If it’s for personal use, what are the users’ interests – diving, watersports, farming? Will there be visitors? If it’s for development, who will be visiting?

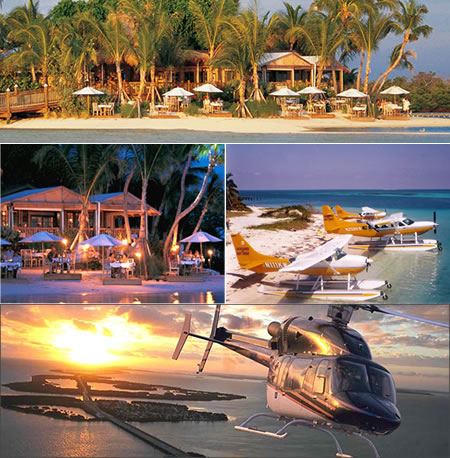

For everyone, accessibility is an issue. How easy is it to get to, and how developed is the infrastructure? Adding roads, water, power and communications can add a great deal to the purchase price. And there’s a fine line between privacy and isolation when supplies are needed or emergencies arise. A private island that’s difficult to get to is a drain on time, energy and money.

Finally, financing can be difficult in some jurisdictions for international buyers. Appraisals can be complex and laws change from location to location. Buyers need to determine if the land is freehold, what the tax structures are and – increasingly crucial – what environmental restrictions and obligations there are.

No matter where your private getaway or future resort is located, a good broker is essential, with reputable agencies including Knight Frank, Savills, Vladi Private Islands, Sotheby’s and Christie’s.

Note: This story was originally published on SCMP and has been republished on this website.